However the total sales tax can be higher depending on the local tax of the area in which the vehicle is purchased in with a maximum tax rate of 1 5.

Florida automobile sales tax rate.

For example if you are a florida resident and are buying.

4 on amusement machine receipts 5 5 on the lease or license of commercial real property and 6 95 on electricity.

Just enter the five digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to florida local counties cities and special taxation districts.

Florida sales tax is due at the rate of six percent on the 20 000 sales price of the vehicle.

The full purchase price generally is the amount you actually pay for the vehicle.

Multiply the sales price of the vehicle by the current sales tax rate.

Florida collects a 6 state sales tax rate on the purchase of all vehicles.

For example if you re a florida resident buying a vehicle with a total sale price of 18 252 your sales tax is 1 095 12 18 252 x 06.

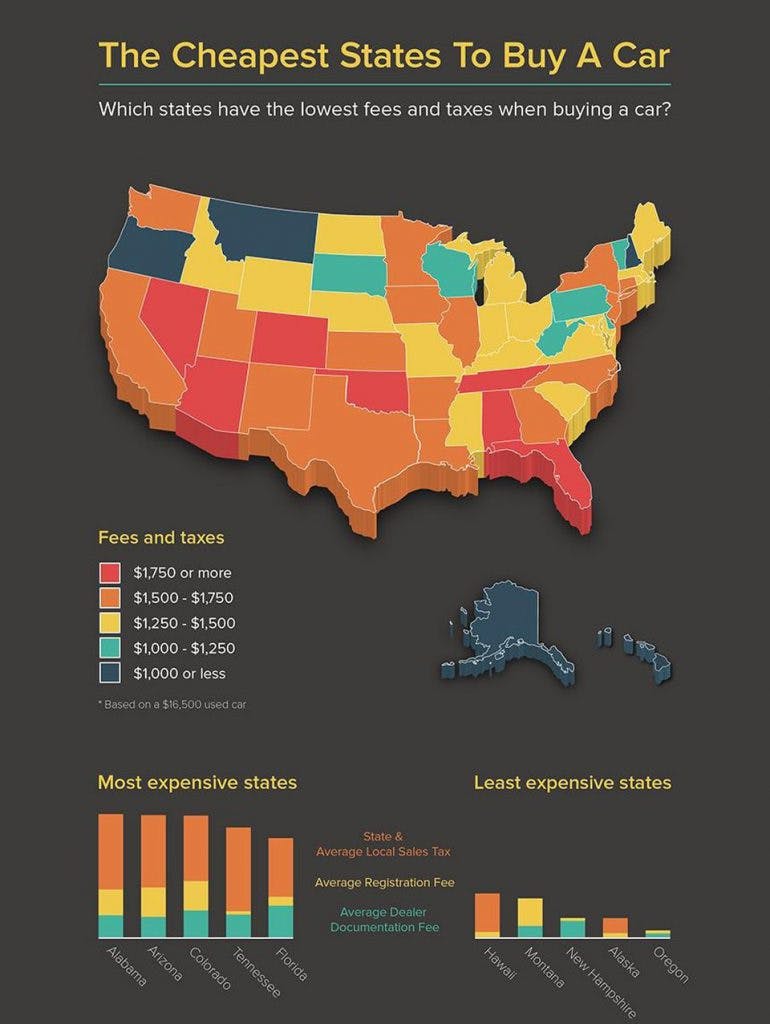

Find your state below to determine the total cost of your new car including the car tax.

Some states provide official vehicle registration fee calculators while others provide lists of their tax tag and title fees.

No discretionary sales surtax is due.

Auto sales tax and the cost of a new car tag are major factors in any tax title and license calculator.

Sale of 20 000 motor vehicle to a resident of another state where the sales tax rate on motor vehicles is seven percent.

Florida assesses a state sales tax of 6 percent on the full purchase price of the vehicle at the time of publication.

However if you buy from a dealer and get a manufacturer s rebate florida does not deduct the rebate amount from the purchase price.